No, It’s not about burning money. FIRE stands for Financial Independence, Retire Early. You might have heard of it before but never really paid attention, or you might be obsessed with it (I happen to fall into the latter). FIRE has been gaining so much popularity in recent years and has made it into numerous headlines of major news networks. The movement has spread quickly through online communities and has influenced many people to change the entire way they live. FIRE has even been referred to as a sort of “cult” but what exactly is the fire movement?

The FIRE movement is a recent development where people increase their savings rates to over 50% for their income by optimizing their lifestyle to spend less money and/or make more money. It is a popular movement because lots of people are finding joy in reshaping their lives to follow the basic principles of FIRE. Only you can decide if the FIRE movement is right for you, hopefully, with this post, I can convince you that it might be.

Jump Ahead To:

Many People Are Reshaping Their Lives For FIRE

FIRE is a lifestyle. It is a shift in the thought process about life and money and how it all works. Most people in this world see money as something you work for and spend, then you continue on with the cycle for 40+ years. We in the FIRE community see money as a tool. Money is a tool that can be used to break the cycle. It’s really quite liberating to feel control over something that many people feel has control over them.

The FIRE movement is about seeking more time, not more money. Nearly everything we are exposed to is about making more money, accumulating more wealth, earning more, etc. But what those of us following the FIRE movement have come to realize is that time is so much more important to money. Time is a finite resource, a very precious and finite resource. Money, on the other hand, is unlimited in theory. There is no real limit on how much money you can earn, make, or accumulate. We can see this by studying the “richest” individuals in the world because many have accumulated so much wealth beyond what they may have thought to be possible in their own minds at one point.

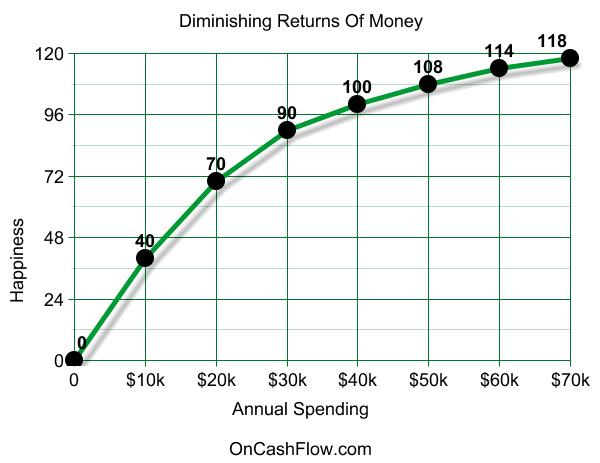

If you know about the FIRE movement at all then you might have noticed that the goal is not to accumulate an unbelievable amount of riches. The goal is to accumulate “just enough” because money has a diminishing return of satisfaction. True satisfaction that is, true happiness diminishes quickly with money, the first $30,000-$40,000 (Depending on your cost of living) is probably the most satisfying whether you realize it or not because it provides for our basic needs. Our basic needs usually consist of food, water, shelter, clothing, and maybe a few other things if you really want to expand on it.

With FIRE, not only does your attitude towards money and time change, but the things you enjoy doing might change along with that. Many of us in The FIRE movement enjoy low-cost hobbies that bring great benefit and joy to us, many also follow their passions, whether that be related to hobbies, a dream job, or an entrepreneurial desire. With hobbies, If I had to list the most common hobby that most people with FIRE on their mind enjoy it would be reading. You are doing some reading right now, that’s awesome. Not only reading articles but books too, we in the FIRE movement have many books we love to turn to for knowledge and guidance. I myself have read many personal finance books and have some favorite books that I recommend.

We Follow The Basic Principles Of FIRE

The FIRE movement is all about optimizing your lifestyle when you are trying to reach financial independence. Financial independence is when you have enough money in investments to cover your spending for essentially the rest of your life. You can optimize your lifestyle by smartly increasing your income, decreasing your expenses, or a combination of the two.

If you want to optimize your spending, the best place to start is by looking at the big 3 expenses. The big three expenses are housing, transportation, and food. The big 3 expenses usually cover roughly 70% of our overall spending whether we realize it or not. They tend to go in that order from largest to smallest with housing usually being the largest expense. Keep in mind that housing doesn’t just include the mortgage or the rent. It also includes things like utilities, insurance, taxes, and repairs. Similarly, transportation doesn’t include just gas for your car, it includes things like insurance, registration, maintenance, repairs, depreciation, etc. Lastly, food doesn’t just include groceries from the grocery store, there is restaurants, fast food, vending machines, convenience store food, etc. Get those expenses in check, then you can tweak the other 30% to your liking.

Another thing that you definitely need to optimize is any debt that you might have. Preferably you want to eliminate debt as quickly as possible, especially if the interest rate you are paying is higher than the interest rate that you would reasonably expect to make otherwise. For example, if you have $5,000 in credit card debt at 20% interest, then you should definitely pay that debt off as quickly as possible instead of investing because, for the most part, it is unrealistic to expect a return on investment of 20% or more. A conservative rule of thumb I like to use is that if the debt is over 7% then I would pay it off as fast as possible, but that’s just me.

Increasing your income is another way to optimize your lifestyle in order to prepare for FIRE. There are nearly unlimited amounts of ways to do this, just as there are unlimited ways to cut spending. Here are some basic and reliable ways:

- Increase your income at work either through seeking promotions, raises, or bonuses.

- Switch to a higher paying job

- Get a side hustle

- Starting a side business

- Using high-interest bank accounts

- Renting out a room in your house (like on Airbnb)

- Selling your stuff

- Credit card sign up bonuses (use responsively)

Once you have gotten down reducing expenses and/or increasing income, you need to be saving at least 50% of your income in order to successfully “join the ranks” of the FIRE movement. By saving, I actually mean investing that money so it can grow for you. This is a huge topic in and of its own, but some great investments for those of us in FIRE are stock index funds, bond index funds, real estate, REITs, etc. Of all of this wealth you end up accumulating, your goal is to have enough to where you can safely withdraw 4% or less of its worth per year to cover your annual expenses.

Above all, even though it will be hard work and it will take some sacrifice, you should still enjoy the journey. FIRE is not just about sacrifice and doing without, It is about maximizing happiness by having more control over your time and of your money. It gives you a reason to never have to fear money again because you are making money work for you instead of you just working for money. If you are trying to achieve financial independence and your not happy while doing it, then you are doing it wrong and might actually need to scale back a little, whether that be on the income side or the spending side. Also, realize that reaching FIRE is not the end all be all. It is a great goal to have and it can open up a lot of opportunity for you, but it is not a 100% foolproof plan for happiness.

Is The FIRE Movement Right For You?

I can’t directly tell you if you should be a part of the FIRE movement, only you can decide that for yourself. What I can do is give you some questions for you to ask yourself.

Ask yourself 3 short questions to see if FIRE sparks your interest at all.

- Do you want more control over your time?

- Do you want to work for money, or do you want money to work for you?

- Do you find joy in a more simpler life?

If any of those three things might apply to you, then you should probably research the FIRE movement some more. It is filled with amazing people with abundant amounts of knowledge and how-to. I do hope that in some small way I have touched a little on these amazing concepts that FIRE is all about and have ignited something within you to give it a chance. Thanks for reading.

Conclusion

It is easy for me to see why there is so much appeal to the FIRE movement. FIRE represents freedom and control over your most important asset: your time. FIRE is a lifestyle that follows a couple of simple, yet effective principles that allow us to achieve such a beautiful thing. No matter if FIRE is right for you, or if FIRE doesn’t interest you at all, you still have to admit that it does have a sort of appeal to it that could apply to everyone in some way.